You may have noticed a weird symbol floating around on Twitter and Instagram recently: $GME.

$GME is the stock ticker for the company GameStop. GameStop is the company known for game rentals and exchanges, made largely obsolete due to the rise of internet gaming, STEAM, etc.

Prior to this week, the company’s stock price looked like this:

The GameStop stock was in decline, at around $19 per share.

Several large, institutional investors decided to publicly state their short position (meaning they bet on the stock price to go down, thus reflecting the demise of the company).

One such company is Melvin Capital Management. Melvin Capital manages over $12.5 billion in assets and is one of the top-performing hedge funds.

Until this week.

Reddit Army Takes Down Wall Street Giant

A Reddit internet forum called “Wall Street Bets” decided to take on Melvin Capital, in what amounts to a rag-tag group of revolutionaries trying to fight a giant hedge fund.

Their theory? Rally a huge group of tiny investors to buy GameStop stocks to force the stock price up. The stock price increases and puts pressure on Melvin Capital. (Remember, when a stock price increases short sellers lose money) If this could be done at-scale, with thousands of small investors, the hedge fund could be forced out of their position.

And thus it started.

Wall Street Bets began collectively buying GameStop stocks. Other small investors hopped into the frenzy, driven by the David vs Goliath narrative. Even Elon Musk supported the movement by tweeting:

The result?

As of today, the stock price is $366.43 per share… an astounding 1,619% gain in the past month.

Melvin Capital had to be bailed out by a larger hedge fund, Citadel, after losing over $2.75 BILLION to this marauding populist army of traders.

The saga continues, with speculation of mainstream media manipulation trying to cover for hedge funds.

The SEC might step in according to experts. The NASDAQ has threatened to shut down trading, citing “social media chatter” they didn’t appreciate.

Even brokerages (places where normal people can buy and sell stocks) are shutting down the trading of certain stocks, to protect these hedge funds.

Populist Traders Revealed the Collusion and Manipulation of Hedge Funds

Large media organizations will likely accuse these small traders of colluding to manipulate the stock price.

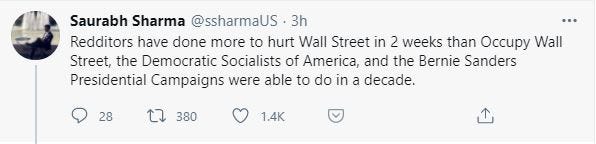

In reality, these small traders are returning the favor of what hedge funds and institutional investors have done for ages: manipulate stocks using their collective money, media presence and connections in government.

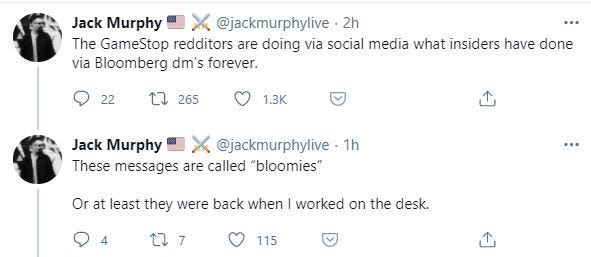

Former investment banker Jack Murphy described this process on Twitter, stating:

Now that the “gun” of monetary capital has turned on these hedge funds ONE TIME, they beg for a bailout and government regulation.

The Future of Populist Action Against Giant Corporations: Crowdsourced Capital Strikes

Populists, both on the Left and Right, are speculating if this type of mass trading could be used as a negotiating tool of the people in the future.

Will this happen? I’m not sure.

But for now, grab a bowl of popcorn and enjoy the show.

This article was originally published on Millennial Pen Politics.