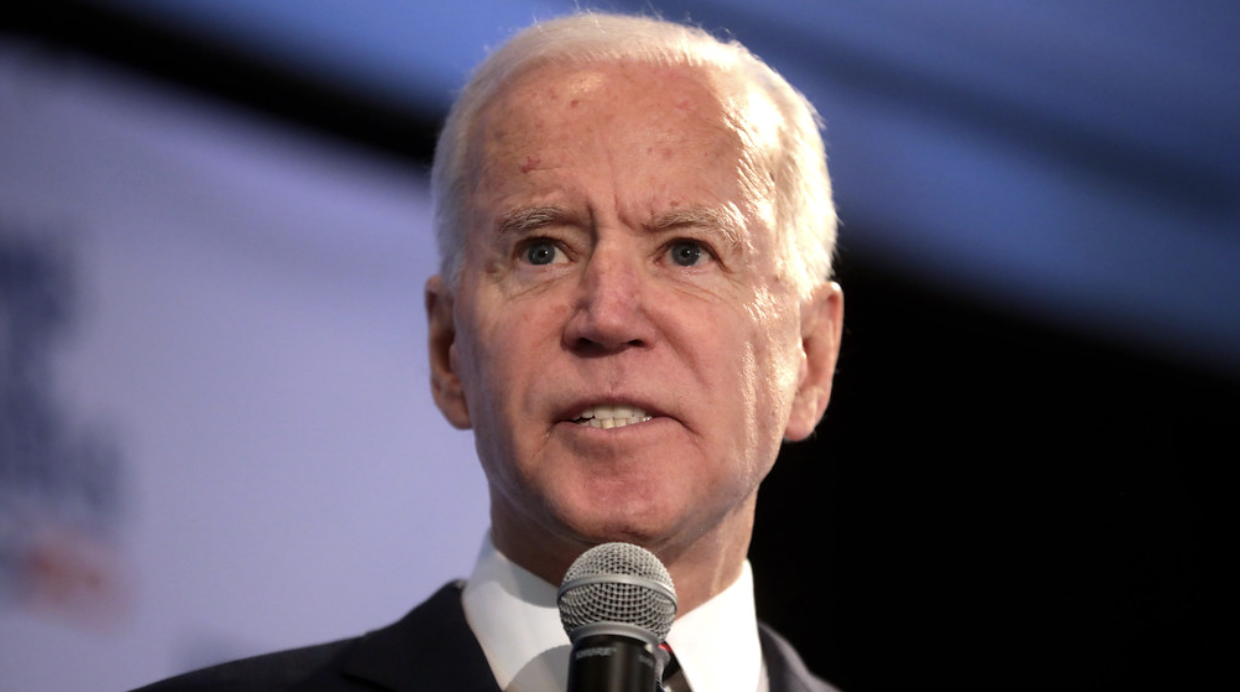

Banks Killed Bush, But What About Biden?

If Joe Biden isn’t privately panicking over the two recent major bank failures, he really is the worst leader in U.S. history.

While nearly 100 banks with a billion dollars or more in assets have failed in the last 50 years, the collapse of the Silicon Valley Bank this week is the second largest in that period — at $209 billion in assets, its demise is dwarfed only by the downfall of Washington Mutual in 2008, which held $307 billion.

The mainstream media has been able to downplay the demise of the other big bank to expire this month (Signature Bank), but only because the SVB collapse was twice the size. Signature’s assets totaled $118 billion, for a combined $327 billion in losses. The nine (or so) big banks that expired in 2008 had a higher combined value, but not by much, and anyone who assumes the bank failures of 2023 are over is a fool.

Some of the recent losses may be recoverable (a bank’s buildings can be sold) but that will make, at best, a miniscule dent in the damage done to investors and depositors. While the U.S. government (FDIC) guarantees that accounts with $250 thousand or less will be reimbursed, guess who’s on the hook for that?

That’s right — you are.

Taxpayers are now liable, by law, for billions of dollars in losses, and the only way the government can pay is to print more money. If you think inflation is bad now, just wait. The total revenue brought in by the U.S. government in 2022 was $4.896 trillion. The equivalent of seven percent of that was just went up in smoke — and don’t think for a moment that Biden won’t try to bail out the wealthy Silicone Valley leftists who invested SVB or deposited outside of the $250 thousand insurance limit.

When banks collapsed in 2008, it hurt the economy in countless ways. Other banks and lenders had to tighten their belts to avoid a similar fate, so loans became hard to come by. Partly as a result, the housing market collapsed, and major auto industries started to fail. But, as bad as it was at least the economy was healthy enough to survive it.

As much as I despised the bank and auto bailouts of 2008 and 2009 as throwing good money after bad, the country could (sort of) afford it. Back then, the U.S. hadn’t flushed trillions away on COVID shutdowns and stimulus checks. Back then, the debt hovered around $10 trillion, not $31 trillion. Back then, the economy was also just coming off quite a few good years.

None of that is the case now.

ALSO TRENDING: BOMBSHELL REPORT: Taxpayer-Funded Non-Profit Is TEACHING Migrants How To Illegally Enter America (DETAILS)

The only silver lining is that maybe, this time, Biden’s media lapdogs won’t be able to protect him. The 2008 recession ruined any remaining chance of Republicans retaining the White House (not that candidate John McCain qualified as a Republican) and Biden’s failures on the economy may soon become apparent even to the worst of the brainwashed leftists.

Maybe.

One Response